Australian marketer confidence rebounds to highest level in three years, new report finds

Media Release - Australia - 10 July 2025: Australian marketers have reported a huge surge in confidence this year, with 71% reporting optimism for the year ahead despite ongoing budget and other pressures, according to Sonar Group’s annual Australian Marketers Benchmarking Report 2025.

The 2025 report draws on the perspectives of senior marketing leaders, with over 82% of respondents holding roles such as CMO, CXO, Marketing Director or Head of Marketing, Brand or Digital. Respondents also spanned a range of industries - from retail and financial services to technology and not-for-profit - working within mid-sized organisations of 201–500 employees.

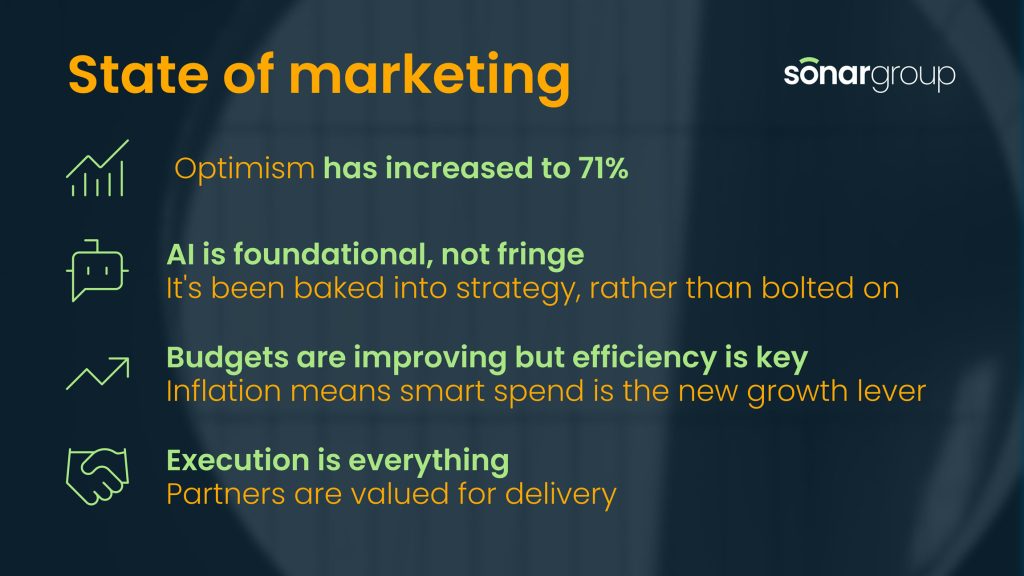

Now in its third edition, the report shows a 15% jump in optimism after confidence fell to 56% in 2024. With stabilising budgets and a clearer playbook for automation and AI, marketers are building towards more efficient, sustainable growth.

Scott Heron, Managing Director and Co-Founder at Sonar Group, says: “It’s great to see some confidence re-entering the market, and that is showing in the way clients are approaching their marketing activities. The optimism is real, but it’s not naive - marketers know the stakes are high and they’re making smarter and more strategic moves in response.”

Key findings from Marketing Trends in 2025

- AI moves from hype to habit: Generative AI adoption has surged from 20% in 2023 to 70% in 2025, with teams now using it for content, workflow support and insight generation. But whilst usage is high, many marketers are still grappling with how to turn adoption into impact.

- Marketing automation investment is the priority: Scalable delivery is now non-negotiable, with 58% of respondents seeing marketing automation as their top investment priority this year compared to just 17% in 2023 and 49% last year.

- Budgets expected to rise or stabilise: The majority of marketers (76%) expect budgets to hold steady or increase - however, inflation may neutralise some of those gains, meaning marketers are still expected to do more with the same. Despite this, the overall mood has markedly improved from last year’s uncertainty.

- Teams set to hold or grow: In spite of forecasted AI-decimation of marketing jobs, 70% of marketers anticipate the size of their team to either grow or remain the same. Team structures are instead evolving, with most leaders focused on upskilling in AI, data and personalisation - shifting towards hybrid skills.

- Marketing is reclaiming its seat at the table: Marketing is increasingly viewed as a value driver or cost centre in organisations, with 72% of respondents believing their department is seen as such - a jump from 64% last year.

Heron adds: “What’s interesting is the sentiment we’re seeing around emerging tech like AI. Two years ago, it was met with uncertainty and scepticism because of so many unknowns - now, it is being used to enable marketers and enhance performance. It's no longer a side project, it’s becoming increasingly embedded in the day-to-day of marketing teams and is fundamentally reshaping how brands operate.”

Industry specific insights

Sector-specific trends also point to a changing landscape. Highlights include:

- Retail marketers leading the confidence curve, with 82% positive about the year ahead.

- Financial services marketers reporting high intent to invest in AI at 75% compared to the average 48%.

- Not-for-profits are more interested in upskilling their team in generative AI (86%), personalisation (86%) and data and analytics (57%) than the average.

What does this mean for us as marketers?

As marketers balance tighter spending conditions with rising expectations, the report points to a shift in how leaders are operating. Execution is critical but there’s a growing appetite for partners who can deliver efficiently and support sharper, more commercially focused decision-making.

“With foundations in place, it’s now about building intelligent operations to fuel the next phase of growth in Australia’s marketing landscape,” Heron added.

Download the report here!